-

Openness, Perseverance,Advancing with the times

-

[Huayou on Media] Chairman Chen Xuehua of Huayou Cobalt: Technological Innovation is Top Priority; Positive Outlook for Ternary Materials

2025-04-30 -

Special Issue of International Business Daily — Huayou Indonesia IPIP Park: Building a New Benchmark for Global Lithium Battery Industry and Jointly Creating a Green Future

2025-04-22 -

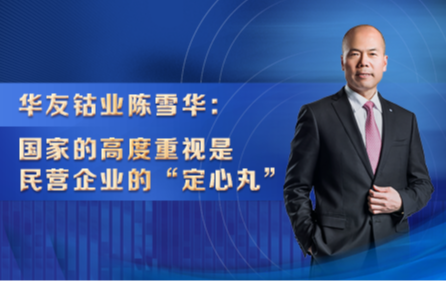

【Huayou on Media】Chen Xuehua of Huayou Cobalt — "National Support is the Reassurance Private Enterprises Need"

2025-03-05

[Huayou on Media] Chairman Chen Xuehua of Huayou Cobalt: Technological Innovation is Top Priority; Positive Outlook for Ternary Materials

-

2025-04-30

-

Page views:19

Recently, Huayou Cobalt (stock code: 603799) held a performance briefing which attracted significant attention from institutions and investors due to its better-than-expected financial results. Chairman Chen Xuehua answered detailed questions from investors covering topics such as company operations, trends in ternary materials, nickel price movements, development plans for nickel resources in Indonesia, and international operations.

"The projects in Indonesia will be built one better than the last," said Chen Xuehua confidently to investors, emphasizing that through coordinated development in technology, management, and resources, the time has come for ternary materials to play a pivotal role. He also mentioned that the company will increase investment in technological innovation to further enhance its technical capabilities. Currently, market expectations for future orders are optimistic.

“Technological innovation is our top priority”

"In manufacturing enterprises, it's crucial to hone your basic skills," reiterated Chen Xuehua when responding to investor inquiries, highlighting technological innovation as the foremost item in their strategic planning. He explained that by covering all aspects from resource development to end-use materials with industry leaders, they aim to lead scientific development within the sector. Especially important is amplifying the advantages of an integrated industry chain, which becomes more apparent at scale. Smaller scales might not fully showcase these benefits.

Furthermore, the company will periodically increase efforts in resource development. Chen emphasized that product leadership and cost leadership are critical supporting elements, requiring management innovation, technological advancement, and enhanced resource control and development capabilities. Focusing on resource ends, the company will continue to strengthen this area, converting superior resources into competitive advantages.

After the announcement of Huayou Cobalt’s 2024 annual report and Q1 2025 financial results, multiple institutions commented positively on the company's outperformance. According to the announcements, net profit for 2024 was 4.155 billion yuan, representing a year-on-year growth of about 24%, while Q1 2025 saw a net profit of 1.252 billion yuan, marking a year-on-year increase of approximately 140%.

When asked about the primary drivers of future profitability, Chen Xuehua stated that "rebuilding another Huayou" is the fundamental goal of the company's development. The driving forces behind this include the advantages of an integrated industry chain, international operations, comprehensive technological innovation, and high-level ecological advantages.

Huayou Cobalt insists on positioning new energy lithium battery materials as its core business, supported by nickel-cobalt-lithium resource guarantees, adhering to the path of transformation and upgrading characterized by "upstream resource control, downstream market expansion, and midstream capability enhancement." By leveraging the advantages of an integrated industry chain, international operations, comprehensive technological innovation, and high-level ecological advantages, the company aims to firmly grasp opportunities presented by the new round of technological revolution and industrial transformation.

“Ternary materials are expected to regain their rightful position over the next three years.”

"The international market still primarily relies on ternary materials," noted Chen Xuehua, explaining that 2024 served as a foundation-building year for ternary materials, marking a fresh start, while 2025 is set to be the first year of regaining its proper place within the next three years.

Chen analyzed that despite the current increase in the market share of lithium iron phosphate materials, ternary materials retain broad prospects for development due to their performance advantages in the mid-to-high-end passenger car market. Particularly, with the increasing penetration rate of ternary materials in emerging fields like AI robots and low-altitude drones, along with the acceleration of solid-state battery industrialization, demand for high-nickel ternary materials is poised for explosive growth.

Moreover, given the good recyclability of nickel and cobalt metals, the cost-effectiveness of ternary materials has become more prominent, offering a lifecycle cost advantage. With nickel prices stabilizing between 15,

Huayou Cobalt has always placed great importance on R&D and innovation in ternary materials, continuously increasing investment in scientific research to promote improvements in product performance and cost optimization. Through cooperation with domestic and foreign universities and research institutions, as well as the efforts of its own research team, the company has achieved a series of technological breakthroughs in high-nickel ternary materials, continuing to lead the development of the ternary material industry.

“The projects in Indonesia will be built one better than the last.”

In terms of global layout and international operations, Huayou Cobalt has established an operating pattern encompassing overseas resources, international manufacturing, and global markets. Chen Xuehua introduced that the company is actively laying out resource development projects in resource-rich regions such as Indonesia, Congo (Kinshasa), and Zimbabwe, while constructing advanced manufacturing bases both domestically and internationally, including Hungary.

"No investment without resources; no investment without good partners," Chen Xuehua emphasized, indicating that Indonesia serves as the main battlefield for Huayou Cobalt's transformation and upgrading. Under these premises, the company will further increase its investments in Indonesia in a healthy, safe, and sustainable manner.

Regarding investors' concerns about development plans for nickel resources in Indonesia, Chen Xuehua revealed that two major projects are entering the countdown phase for production: the Pomalaa wet smelting project in collaboration with Vale Indonesia and Ford Motor, with an annual capacity of 120,000 tons of nickel metal, is expected to be put into operation by the end of 2026; the Sorowako high-pressure acid leaching project, also in partnership with Vale Indonesia, with an annual capacity of 60,000 tons of nickel metal and 5,000 tons of cobalt metal, is scheduled for completion in 2027. In the future, Huayou Cobalt will continue to increase its resource development efforts in Indonesia, perfecting its industrial chain layout and strengthening its resource guarantee capabilities.

"The projects in Indonesia will be built one better than the last," Chen Xuehua confidently told investors. Current technological advancements have significantly improved the operational efficiency and reduced costs of related projects. The company will adhere to an open development strategy, further deepen its global layout, and continuously improve its ability to participate in global resource allocation, integrate into the global industrial division, and join the global market competition, gradually realizing its transition from a Chinese enterprise to a world-class enterprise.

-E N D-

來源 ▏證券時報

編輯 ▏呂亞晴

審核 ▏劉 強

-

Southeast/South/East China Business Department, New Energy Marketing Centre

Ternary Cathode Materials Industry (Domestic Markets)

-

Japan& Korea Business Department, New Energy Marketing Center

Ternary Cathode Materials Industry (Japanese &Korean Markets)

-

European& American Business Department, New Energy Marketing Center

Ternary Cathode Materials Industry (European& American Markets)

-

Operation Department, Recycling Industry Group

Domestic Waste Power Battery and Material Recycling Industry