-

Openness, Perseverance,Advancing with the times

-

Governor of Southeast Sulawesi Province in Indonesia Inspects IPIP Park: Government and Enterprise Collaboration to Build a New Benchmark for Green Industry

2025-05-12 -

Huayou Energy Successfully Achieves Export of Lithium-ion Batteries for AGVs to Japan

2025-05-12 -

Seminar on ESG Strategic Planning: Discussing Sustainable Development

2025-05-12

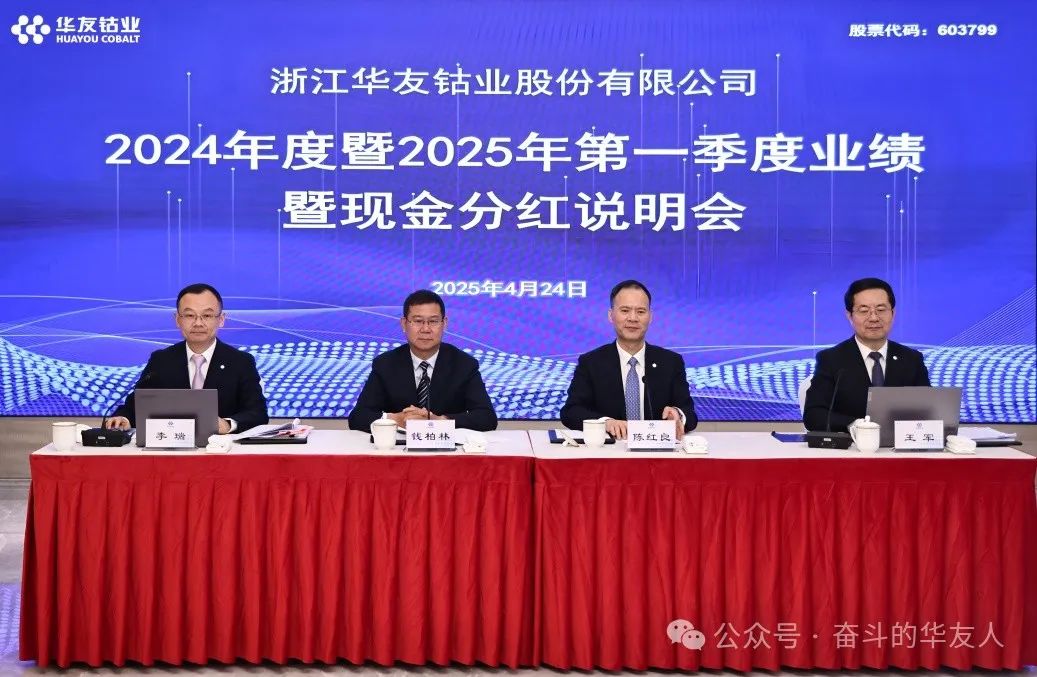

Huayou Cobalt's 2024 Annual and 2025 First Quarter Performance and Cash Dividend Briefing Held

-

2025-05-07

-

Page views:26

In 2024, the company achieved a revenue of 60.946 billion yuan, with a net profit attributable to the parent company of 4.155 billion yuan, representing a year-on-year increase of 23.99%, marking the best operating performance since the company's establishment. The net cash flow from operating activities was 12.431 billion yuan, up 256.61% year-on-year, indicating a significant improvement in operating quality. By the end of the reporting period, total assets reached 136.591 billion yuan, an increase of 8.82% compared to the previous year, while the net assets attributable to the parent company were 36.946 billion yuan, a growth of 7.78%. For the fiscal year 2024, the company plans to distribute a cash dividend of 5 yuan per 10 shares (tax included) to all shareholders, totaling approximately 840 million yuan, accounting for 20.20% of the annual net profit attributable to the parent company, continuously returning value to shareholders.

On April 24th, Huayou Cobalt held its 2024 annual and 2025 first quarter performance and cash dividend briefing through a live video broadcast on the SSE Roadshow Center platform, aiming to communicate more directly and effectively with global investors via this online platform and timely understand their opinions and suggestions regarding the company’s operations and development. Chairman Chen Xuehua, President Chen Hongliang, independent director Qian Berlin, Senior Vice President and CFO Wang Jun attended the meeting. The briefing was chaired by Li Rui, the company secretary of the board.

Chairman Chen Xuehua systematically and thoroughly answered questions raised by investors concerning topics such as the company’s strategic goals, nickel resource development plans in Indonesia, future trends in ternary materials, nickel price movements, global layout, international operations, open cooperation, etc.

President Chen Hongliang represented the company in delivering a speech. He expressed gratitude to investors, friends from all sectors of society for their concern, trust, and support. He mentioned that in 2024, facing profound changes in industry conditions and operating environments, the company adhered to transformational development and a firm strategic orientation, upheld the core principle of "customer-centricity" and "creating value for customers," implemented the work requirements of steady progress and winning amidst advancement, strengthened comprehensive coordination, optimized industrial structures, reinforced technological support, promoted cost reduction and efficiency improvements, achieving the best operating performance since its establishment. The initial formation of overseas resources, international manufacturing, and global market industrial layouts has further enhanced the company’s capabilities in participating in global resource allocation, integrating into global industrial division, and competing in the global market. This has comprehensively improved the competitive advantages of integrated industries, successfully maintaining its position among China’s Top 500 Enterprises.

Chen Hongliang also pointed out that 2025 is not only the concluding year of the "14th Five-Year Plan" but also the planning year for the "15th Five-Year Plan." It is also the harvest year for Huayou to achieve greater results within five years instead of ten. The company will implement a business philosophy prioritizing market leadership, benefit orientation, structural optimization, and robust safeguards, strengthen risk management in safety, environmental protection, and operations, enhance the three major elements of quality, cost, and benefits, reinforce scientific and technological innovation, promote management reforms, improve total factor productivity, fully drive high-quality corporate development, and strive to create excellent performance to reward shareholders and stakeholders.

Senior Vice President and CFO Wang Jun reported on the operational status for the fiscal year 2024 and the first quarter of 2025. He introduced six aspects: maintaining steady progress and setting new records in business performance; enhancing innovation-driven capabilities with notable advancements in technological innovation; deepening global layouts and further strengthening the momentum for high-quality development; driving management reforms to solidify the foundation for high-quality development; elevating ESG management to lead green development in the industry; valuing shareholder returns and sharing development outcomes.

During the meeting, the company secretary of the board provided explanations regarding the cash dividend distribution for the fiscal year 2024.

-E N D-

文字 ▏秦廣浩

編輯 ▏呂亞晴

審核 ▏劉 強

-

Southeast/South/East China Business Department, New Energy Marketing Centre

Ternary Cathode Materials Industry (Domestic Markets)

-

Japan& Korea Business Department, New Energy Marketing Center

Ternary Cathode Materials Industry (Japanese &Korean Markets)

-

European& American Business Department, New Energy Marketing Center

Ternary Cathode Materials Industry (European& American Markets)

-

Operation Department, Recycling Industry Group

Domestic Waste Power Battery and Material Recycling Industry